Project3

Project 3

Kara Belknap & Cassio Monti 2022-11-5

- Report for the tech Data Channel

Report for the tech Data Channel

This report contains Exploratory Data Analysis (EDA) about the tech data channel and a modeling section applying different regression methods which attempt to predict trends about article sharing on the Mashable website.

Introduction

The objective of this analysis is to provide a comprehensive overview

about publication metrics and their relationship with the number of

shares that those publications presented during the study period. These

data have been collected from Mashable website, one of the largest news

websites from which the content of all the tech channel articles

published in 2013 and 2014 was extracted. The full data description can

be found

here.

These data were originally collected and analyzed by Fernandes et

al. (2015), in which the authors performed

classification task comparing several machine learning algorithms. In

the present study, a subset of the data used by Fernandes et al.(2015)

corresponding to the data channel tech is used for regression

purposes. The response variable is the number of shares that the

papers presented after publication. In other words, we will try to

predict the number of shares that the papers will have before

publication and evaluate the prediction of each selected model based on

some common metrics, such as RMSE (Root Mean Squared Error), RSquared

(Coefficient of Determination), and MAE (Mean Absolute Error) applied to

the test set. To perform the regression, the methods Random Forest,

Boosting, Multiple Linear Regression, and LASSO regression will be used.

More information about the methods will be provided in the corresponded

sections.

Some metrics have been calculated based on the information obtained from Mashable website. For instance, the Latent Dirichlet Allocation (LDA) was applied to the data set to identify the 5 top relevant topics and then measure the closeness of the current article to such topic. There are 5 relevance of topic metrics according to LDA:

LDA_00: Closeness to LDA topic 0LDA_01: Closeness to LDA topic 1LDA_02: Closeness to LDA topic 2LDA_03: Closeness to LDA topic 3LDA_04: Closeness to LDA topic 4

Additionally, some quality metrics related to the keywords have been calculated and will be used in this analysis. These metrics represent the average number of shares for publications with worst, best, and average keywords. The classification of keywords under these groups was made by the authors of the original paper. The keyword metrics are shown below.

kw_avg_min: Worst keyword (avg. shares)kw_avg_max: Best keyword (avg. shares)kw_avg_avg: Avg. keyword (avg. shares)

Article content metrics were also used in this study. These are general metrics about the body of the publication that can influence the number of shares of that paper. The content summary metrics are shown below.

num_videos: Number of videosn_tokens_content: Number of words in the contentn_non_stop_unique_tokens: Rate of unique non-stop words in the contentnum_hrefs: Number of linksnum_self_hrefs: Number of links to other articles published by Mashableaverage_token_length: Average length of the words in the content

These data were collected during 2013 and 2014 on daily basis. To

represent time dependent information, a binary variable indicating

whether the publication was made in a weekend or weekday, is_weekend

is used.

Data Import and Manipulation

Required Packages

Before we can begin our analysis, we must load in the following packages:

library(tidyverse)

library(caret)

library(GGally)

library(knitr)

Tidyverse is used for data management and plotting through dplyr and

ggplot packages. Caret package is used for data splitting and

modeling. GGally is used for nice correlation and exploratory plots

assisting in the visualization. knitr package is used to provide nice

looking tables.

Read in the Data

Using the data file OnlineNewsPopularity.csv, we will read in the data

and add a new column corresponding to the type of data channel from

which the data was classified. The new variable will be called

dataChannel. Note that there are some rows that are unclassified

according to the six channels of interest and those are indicated by

other. The data indicated by other was excluded from all reports

since the data had not been assigned to one of our channels of interest.

Once the data column is created, we can easily subset the data using the

filter function to create a new data set for each data channel. We

removed the original data_channel_is_* columns as well as two

non-predictive columns url and timedelta.

# reading in the data set

rawData <- read_csv("../OnlineNewsPopularity.csv")

# creating new variable to have more comprehensive names for data channels.

rawDataChannel <- rawData %>%

mutate(dataChannel = ifelse(data_channel_is_lifestyle == 1, "lifestyle",

ifelse(data_channel_is_entertainment == 1, "entertainment",

ifelse(data_channel_is_bus == 1, "bus",

ifelse(data_channel_is_socmed == 1, "socmed",

ifelse(data_channel_is_tech == 1, "tech",

ifelse(data_channel_is_world == 1, "world",

"other"))))))) %>%

select(-data_channel_is_lifestyle, -data_channel_is_entertainment,

-data_channel_is_bus, -data_channel_is_socmed, -data_channel_is_tech,

-data_channel_is_world, -url, -timedelta)

# assigning channel data to R objects.

lifestyleData <- rawDataChannel %>%

filter(dataChannel == "lifestyle")

entertainmentData <- rawDataChannel %>%

filter(dataChannel == "entertainment")

busData <- rawDataChannel %>%

filter(dataChannel == "bus")

socmedData <- rawDataChannel %>%

filter(dataChannel == "socmed")

techData <- rawDataChannel %>%

filter(dataChannel == "tech")

worldData <- rawDataChannel %>%

filter(dataChannel == "world")

Select Data for Appropriate Data Channel

To select the appropriate data channel based on the params$channel, we

created a function selectData which would return the appropriate data

set and assign it to the data set activeData. This will be the file we

will use for the remainder of the report.

# function to assign automated calls for the different data channels

selectData <- function(dataChannel) {

if (dataChannel == "lifestyle"){

return(lifestyleData)

}

if (dataChannel == "entertainment"){

return(entertainmentData)

}

if (dataChannel == "bus"){

return(busData)

}

if (dataChannel == "socmed"){

return(socmedData)

}

if (dataChannel == "tech"){

return(techData)

}

if (dataChannel == "world"){

return(worldData)

}

}

# activating corresponding data set.

dataChannelSelect <- params$channel

activeData <- selectData(dataChannelSelect)

Summarizations for the tech Data Channel

In this section, we will perform EDA for the data channel tech.

Data Manipulation for EDA

Data Split

This section splits the data set into training and test sets for the

proportion of 70/30. The data summarizing will be conducted on the

training set. To split the data, the function createDataPartition(),

from caret package, was used with the argument p=0.7 to represent

70% of the data should be in the split. The function set.seed(555) was

used to fix the random seed. The code below shows the creation of

training and test sets.

set.seed(555)

trainIndex <- createDataPartition(activeData$shares, p = 0.7, list = FALSE)

activeTrain <- activeData[trainIndex, ]

activeTest <- activeData[-trainIndex, ]

Outlier Detection and Cleaning

In this section we will perform a very important step of EDA, the

outlier detection and cleaning. In order to accomplish this task, we

will use the studentized residuals from a linear regression using the

rstandard() function. Linear models can also be useful for EDA when

analyzing the residuals. This analysis is famous for looking for values

above 2 and below -2 for the standardized residuals in the student

distribution scale, which means that if a residual goes above 2 or below

-2, it is considered an outlier and it is recommended to be deleted. The

code below shows the steps to use this function and cleans the detected

outliers from the training set.

# selecting variables of importance

var_sel = select(activeTrain,starts_with("LDA_"), average_token_length,

is_weekend, n_tokens_content, n_non_stop_unique_tokens, num_hrefs,

num_self_hrefs, num_videos, average_token_length, kw_avg_min,

kw_avg_max, kw_avg_avg, is_weekend)

# fitting a MLR with all important predictors

outlier_mod = lm(activeTrain$shares~.,data=var_sel)

# finding values greater than smaller than -2

a=(1:length(rstandard(outlier_mod)))[rstandard(outlier_mod) > 2]

b=(1:length(rstandard(outlier_mod)))[rstandard(outlier_mod) < -2]

# cleaning these values in the training set.

activeTrain = activeTrain[-c(a,b),]

Data manipulation for statistics

A new created object in this section aims to summarize publications

during weekdays and weekends and create factor levels for them to match

with shares variable. The functions ifelse() was used to vectorize

the IF-ELSE statements associated to mutate(), which took care of

creating and appending the new variable to the data set. The function

factor() was used to explicitly coerce the days of week into levels of

the newly created categorical variable “Day”.

# IF-ELSE statements

statsData <- activeTrain %>%

mutate(Day = ifelse(weekday_is_monday == 1, "Monday",

ifelse(weekday_is_tuesday == 1, "Tuesday",

ifelse(weekday_is_wednesday == 1, "Wednesday",

ifelse(weekday_is_thursday == 1, "Thursday",

ifelse(weekday_is_friday == 1, "Friday",

ifelse(weekday_is_saturday == 1, "Saturday",

ifelse(weekday_is_sunday == 1, "Sunday",

"missingdata")))))))) %>%

mutate(Weekend = ifelse(is_weekend == 1, "Yes", "No"))

# Assigning factor levels

statsData$Day <- factor(statsData$Day,

levels = c("Monday", "Tuesday", "Wednesday", "Thursday",

"Friday", "Saturday", "Sunday"))

EDA: Summary Statistics

Summary Statistics, Number of Articles Shared

The following table gives us information about the summary statistics

for the number of shares for articles in the data channel tech. The

summary() function was used to extract these metrics.

summary(activeTrain$shares)

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 82 1100 1700 2684 3000 27400

Summary Statistics, Number of Articles Shared, Weekend vs. Weekday

The following table gives us information about the average, median, and

standard deviation for the number of shares based on whether the post

was made on a weekend or a weekday. The variable “weekend” was grouped,

via grouped_by(), and for each level the sum, average, median, and

standard deviation of shares were calculated via sum(), mean(),

meadian(), sd(), and summarise() functions. The summary table is

shown below.

statsData %>%

group_by(Weekend) %>%

summarise(sumShares = sum(shares), avgShares = mean(shares), medShares = median(shares), sdShares = sd(shares)) %>%

kable(caption = "Statistics for Shares for Weekend or Weekdays")

| Weekend | sumShares | avgShares | medShares | sdShares |

|---|---|---|---|---|

| No | 11481762 | 2575.541 | 1600 | 2835.669 |

| Yes | 2218220 | 3428.470 | 2300 | 3302.885 |

Statistics for Shares for Weekend or Weekdays

Summary Statistics, Articles Shared by Day of Week

Likewise, this table gives us information about the number of shares by

the day of the week. The same functions were used here, but applied to

levels of variable “Day”. Also, the quantities maximum max() and

minimum min() number of shares by levels of “Day” were calculated.

statsData %>%

group_by(Day) %>%

arrange(Day) %>%

summarise(sumShares = sum(shares), avgShares = mean(shares), medShares = median(shares), sdShares = sd(shares), maxShares = max(shares),

minShares = min(shares)) %>%

kable(caption = "Statistics for Shares Across Days of Week")

| Day | sumShares | avgShares | medShares | sdShares | maxShares | minShares |

|---|---|---|---|---|---|---|

| Monday | 2204751 | 2575.644 | 1600 | 2669.282 | 22800 | 192 |

| Tuesday | 2657583 | 2548.018 | 1500 | 2870.587 | 24100 | 104 |

| Wednesday | 2505755 | 2583.253 | 1600 | 2967.460 | 27400 | 181 |

| Thursday | 2230720 | 2506.427 | 1500 | 2810.540 | 24500 | 86 |

| Friday | 1882953 | 2693.781 | 1800 | 2830.068 | 23700 | 82 |

| Saturday | 1209601 | 3251.616 | 2200 | 2891.161 | 21200 | 343 |

| Sunday | 1008619 | 3667.705 | 2400 | 3781.801 | 24000 | 206 |

Statistics for Shares Across Days of Week

Total Articles Shared by Day of Week

Next, we will analyse the frequency of occurrence of publications on each day of the week. The one-way contingency table below presents those frequencies.

table(statsData$Day)

##

## Monday Tuesday Wednesday Thursday Friday Saturday Sunday

## 856 1043 970 890 699 372 275

Contingency Table

Another discrete analysis performed here is the two-way contingency

table related to the discretization of the response variable if we

divided shares into two categories. The function cut() was used for

this end. In this case, we count the frequency of the number of

publications in the weekend versus weekdays with the two levels of

response variable. These levels represent the number of shares between

the minimum and average number of shares (on the left) and between the

average and maximum number of shares (on the right). The table below

shows the frequencies. In the table below, 0 (zero) represents weekdays

and 1 (one) represents weekends.

cutoff = cut(activeTrain$shares,

breaks = c(min(activeTrain$shares),

mean(activeTrain$shares),

max(activeTrain$shares)),

labels = c(paste0("(",round(min(activeTrain$shares),2),

", ",round(mean(activeTrain$shares),2),

"]"),

paste0("(",round(mean(activeTrain$shares),2),

", ",round(max(activeTrain$shares),2),

"]"))

)

table(activeTrain$is_weekend, cutoff) %>%

kable(caption = "Frequency of Shares in Weekend vs in Weekdays")

| (82, 2683.64] | (2683.64, 27400] | |

|---|---|---|

| 0 | 3242 | 1215 |

| 1 | 367 | 280 |

Frequency of Shares in Weekend vs in Weekdays

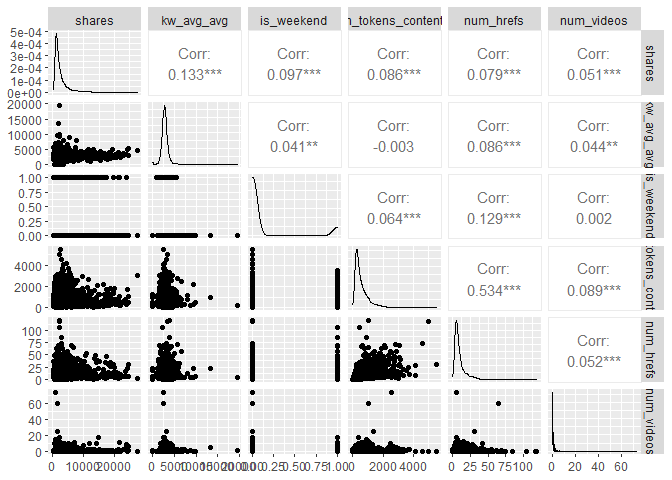

Correlation Matrix

An important EDA analysis for regression tasks is the correlation

matrix. The function cor() is used in this section to return the top

10 most correlated potential predictor variables with the response

variable shares according to Pearson’s Correlation Coefficient. The

code below presents the process of obtaining these variables and their

respective correlations with the response variable. The correlations are

clearly small for this case, which may difficult the modeling process

and produce low quality of prediction metrics.

var_sel = select(activeTrain,starts_with("LDA_"), average_token_length,

is_weekend, n_tokens_content, n_non_stop_unique_tokens, num_hrefs,

num_self_hrefs, num_videos, average_token_length, kw_avg_min,

kw_avg_max, kw_avg_avg, is_weekend)

# correlation matrix

correlation = cor(activeTrain$shares, var_sel)

# sorting the highest correlations

p = sort(abs(correlation), decreasing = T)

# getting column ID

var_id = unlist(lapply(1:10,

function(i) which(abs(correlation) == p[i])))

# collecting variable names

var_cor = colnames(correlation)[var_id]

#combining names with correlations

tbcor = cbind(var_cor, correlation[var_id])

# converting to tibble

tbcor = as_tibble(tbcor)

# updating column names

colnames(tbcor)=c("Variables","Correlation")

# rounding the digits

tbcor$Correlation = round(as.numeric(tbcor$Correlation),3)

# nice printing with kable

kable(tbcor, caption = "Top 10 Response Correlated Variables")

| Variables | Correlation |

|---|---|

| kw_avg_avg | 0.133 |

| is_weekend | 0.097 |

| n_tokens_content | 0.086 |

| num_hrefs | 0.079 |

| num_videos | 0.051 |

| n_non_stop_unique_tokens | -0.049 |

| LDA_01 | -0.037 |

| LDA_02 | 0.028 |

| kw_avg_min | 0.018 |

| LDA_03 | 0.016 |

Top 10 Response Correlated Variables

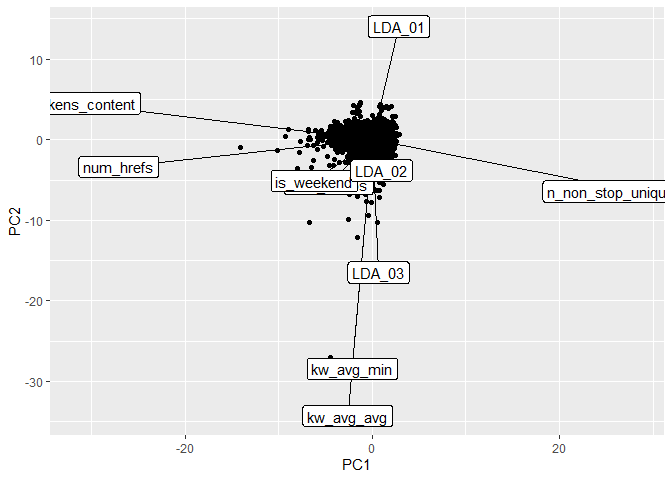

Principal Components Analysis (PCA)

The variables that present highest correlation with the response

variable shares are kw_avg_avg, is_weekend, n_tokens_content,

num_hrefs, num_videos, n_non_stop_unique_tokens, LDA_01, LDA_02,

kw_avg_min, LDA_03. These variables will be studied in more depth via

PCA to understand the orientation of the most important potential

predictors. The code below presents the PCA analysis as part of the EDA.

The 10 PCs displayed in the table below correspond to the most variable

combination of the 10 predictors, which the PC1 has the most variation

in the data, PC2 presents the second most variation and so on. The

coefficients associated to each variable are the loadings and they give

the idea of importance of that particular variable to the variance of

the 10 predictor variables. The negative values only mean that the

orientation of the weights are opposite in the same PC. Since the first

PC has the largest variability, it is possible to say that the variables

with more weights in PC1 might be the most important variables that

contribute more with the variance of the predictors. This variables are

expected to present large influence on the explanation of the variance

of the response variable. The table below show these numbers.

id = which(colnames(activeTrain) %in% var_cor)

# PCA

PC = prcomp(activeTrain[,id], center = TRUE, scale = TRUE)

pc_directions=as.data.frame(PC$rotation)

kable(pc_directions, caption="Principal Components for EDA", digits = 3)

| PC1 | PC2 | PC3 | PC4 | PC5 | PC6 | PC7 | PC8 | PC9 | PC10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| n_tokens_content | -0.616 | 0.089 | 0.008 | -0.044 | -0.084 | 0.006 | -0.027 | 0.016 | -0.082 | -0.772 |

| n_non_stop_unique_tokens | 0.554 | -0.126 | 0.019 | 0.079 | 0.153 | 0.099 | 0.003 | -0.279 | 0.519 | -0.538 |

| num_hrefs | -0.531 | -0.066 | -0.015 | 0.046 | 0.082 | -0.010 | -0.104 | -0.407 | 0.647 | 0.331 |

| num_videos | -0.091 | -0.108 | 0.491 | 0.183 | -0.113 | 0.740 | 0.348 | 0.132 | 0.046 | 0.059 |

| kw_avg_min | -0.042 | -0.558 | -0.149 | -0.502 | -0.036 | 0.108 | -0.188 | 0.543 | 0.264 | -0.009 |

| kw_avg_avg | -0.052 | -0.673 | 0.039 | -0.159 | 0.054 | -0.109 | 0.305 | -0.518 | -0.377 | -0.015 |

| is_weekend | -0.121 | -0.101 | -0.112 | 0.270 | 0.907 | 0.110 | -0.041 | 0.192 | -0.126 | -0.010 |

| LDA_01 | 0.056 | 0.275 | 0.342 | -0.626 | 0.256 | 0.264 | -0.404 | -0.293 | -0.164 | 0.026 |

| LDA_02 | 0.019 | -0.075 | -0.612 | 0.191 | -0.201 | 0.552 | -0.382 | -0.228 | -0.197 | 0.014 |

| LDA_03 | 0.014 | -0.324 | 0.479 | 0.421 | -0.130 | -0.179 | -0.654 | 0.037 | -0.099 | -0.020 |

Principal Components for EDA

id2 = which(abs(pc_directions$PC1) %in%

sort(abs(pc_directions$PC1),dec= T)[1:3])

It is possible to see that the three most important variables in PC1 are

n_tokens_content, n_non_stop_unique_tokens, num_hrefs from the table

above. These variables are considered the most important variables in

terms of variance of the predictor variables. Although the metrics for

prediction are expected to be poor, these variables are expected to show

the most influence to the explanation of the variance of the response

shares.

EDA: Graphical Analysis

Correlation Plot

The plot below presents histograms, scatter plots, and correlations in a

bivariate structure of the top 5 variables chosen in the correlation

analysis. Notice the shape of the distributions and the values of the

correlations relative to the response variable shares.

# bivariate correlation plot

cor_data <- cbind(select(activeTrain,shares),var_sel[,var_id[1:5]])

ggpairs(cor_data)

PCA: Biplot

The biplot below presents the PC1 and PC2 from the PCA analysis. The

function ggplot() was used to create the plot and the segments created

via geom_segment() were re-scaled so that we could better see the

variable names. The most variation in the data is contained in the PC1,

hence, the most important variables in the data are approximately

oriented towards the axis of PC1 and, therefore, may be good predictors

for the shares response. Likewise, for PC2, which contains the second

most variability in the data set, the variables that are oriented

approximately towards the axis of PC2 are the second most important

variables.

pc_df<-data.frame(PC$x)

# plotting PC1 and PC2 for the top 5 variables

# biplot(PC, cex = 1)

ggplot(pc_directions)+

geom_point(data = pc_df, mapping = aes(x=PC1, y=PC2))+

geom_segment(aes(x = 0, y = 0, yend = 50 * PC2, xend = 50 * PC1))+

geom_label(mapping = aes(x = 51 * PC1, y = 51 * PC2, label = row.names(pc_directions)))

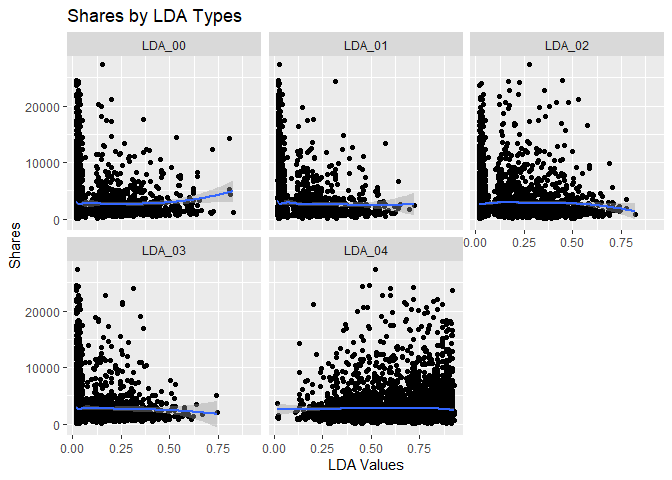

Scatter Plots by LDA Value

The scatter plots below show the different levels of the variables

related to the LDA metrics, from 0 to 4, and graphs the relationship

with the response variable shares. The function ggplot() is used to

create the plot frame and geom_point(), geom_smooth, and

facet_wrap() function are used to plot the scatter points, the smooth

GAM (Generalized Additive Models) lines, and split the data by LDA type,

respectively. It is possible to see the behavior of the response

variable in relation to each LDA types. A common analysis using scatter

plots is related to the pattern shown by the smooth curve fitted to the

points. If this curve shows a flat or constant line parallel to the

predictor axis, then the predictor has little contribution to the

explanation of the variance of the response variable.

LDA.dat = activeTrain %>%

select(shares, starts_with("LDA")) %>%

pivot_longer(cols = LDA_00:LDA_04, names_to = "LDA", values_to = "values")

# relationship between shares and LDA levels (facet_wrap+smooth)

ggplot(LDA.dat, aes(y = shares, x = values))+

geom_point() + geom_smooth(method = "loess")+ facet_wrap(~LDA)+

labs(x = "LDA Values", y = "Shares", title = "Shares by LDA Types")

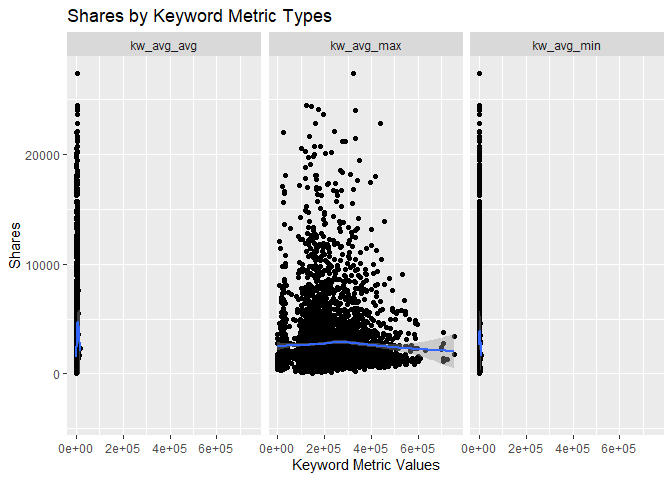

Scatter Plots by Keyword Metrics

The scatter plots below show the different types of the variables

related to the Keyword metrics and graphs the relationship with the

response variable shares. The function ggplot() is used to create

the plot frame and geom_point(), geom_smooth, and facet_wrap()

function are used to plot the scatter points, the smooth GAM

(Generalized Additive Models) lines, and split the data by keyword type,

respectively. It is possible to see the behavior of the response

variable in relation to each of the 3 keyword metric types.

# relationship between shares and keyword metrics

kw.dat = activeTrain %>%

select(shares, kw_avg_max, kw_avg_avg, kw_avg_min) %>%

pivot_longer(cols = 2:4, names_to = "keyword", values_to = "values")

# relationship between shares and keyword metrics types (facet_wrap+smooth)

ggplot(kw.dat, aes(y = shares, x = values))+

geom_point() + geom_smooth(method = "loess")+ facet_wrap(~keyword)+

labs(x = "Keyword Metric Values", y = "Shares", title = "Shares by Keyword Metric Types")

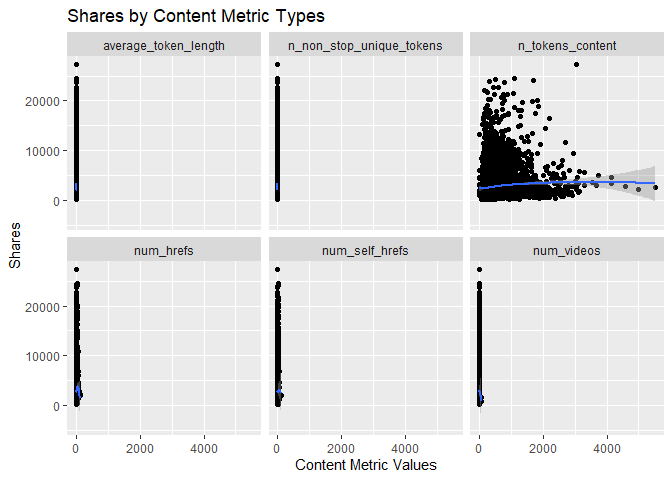

Scatter Plots by Content Metrics

The scatter plots below show the different types of the variables

related to the Content metrics and graphs the relationship with the

response variable shares. The function ggplot() is used to create

the plot frame and geom_point(), geom_smooth, and facet_wrap()

function are used to plot the scatter points, the smooth GAM

(Generalized Additive Models) lines, and split the data by content type,

respectively. It is possible to see the behavior of the response

variable in relation to each of the 4 content metric types.

# relationship between shares and content metrics (facet_wrap+smooth)

cont.dat = activeTrain %>%

select(shares, num_videos, n_tokens_content, n_non_stop_unique_tokens,

num_hrefs, num_self_hrefs, average_token_length) %>%

pivot_longer(cols = 2:7, names_to = "content", values_to = "values")

# relationship between shares and content metrics types (facet_wrap+smooth)

ggplot(cont.dat, aes(y = shares, x = values))+

geom_point() + geom_smooth(method = "loess")+ facet_wrap(~content)+

labs(x = "Content Metric Values", y = "Shares", title = "Shares by Content Metric Types")

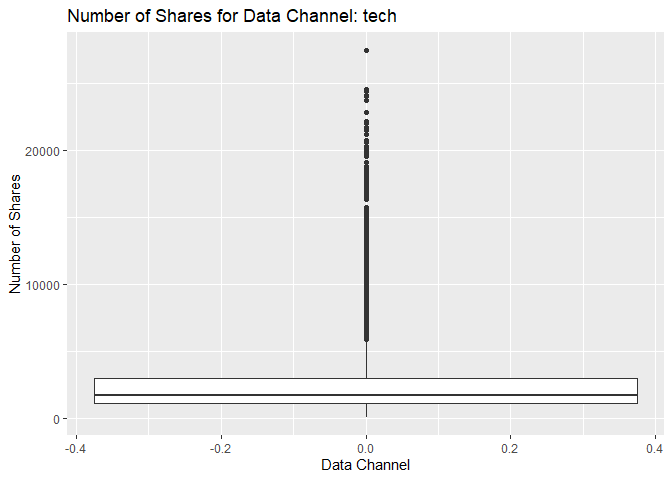

Box Plot of Shares for Data Channel tech

The following box plot shows the distribution of shares for this data

channel. The main chunk of the data can be seen within the “box”

representing the region encompassing the first and third quartiles. For

some cases, there are possible outliers in the data that make

distortions to the box plot and this mentioned “box” looks thinner than

usual. If this happens, then it means that the possible outliers are

much larger than the main chunk of data. The outliers usually appear as

individual points in the box plot. The graph below shows this pattern

for the response variable shares. However, the data might not have

outliers and the highlighted data points are in fact part of the data.

This stresses the importance of knowing about the subject and data set

in order to perform statistical analysis.

boxSharesGraph <- ggplot(statsData, aes(y = shares))

boxSharesGraph + geom_boxplot() +

ggtitle(paste("Number of Shares for Data Channel:", dataChannelSelect)) +

ylab("Number of Shares") +

xlab("Data Channel")

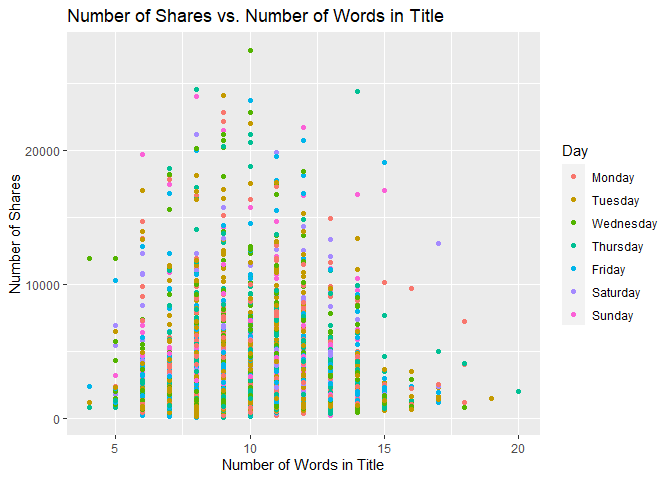

Scatter Plot of Title Words

The following graph shows the number of shares compared to the number of words in the title. The output is colored by the day of the week.

titlewordcountGraph <- ggplot(statsData, aes(x = n_tokens_title, y = shares))

titlewordcountGraph + geom_point(aes(color = Day)) +

ggtitle("Number of Shares vs. Number of Words in Title") +

ylab("Number of Shares") +

xlab("Number of Words in Title")

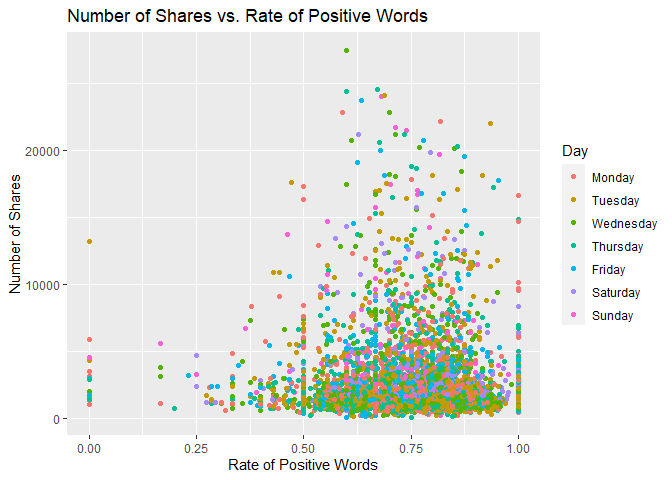

Scatter Plot of Positive Words

The following plot shows the number of shares by the rate of positive words in the article. A positive trend would indicate that articles with more positive words are shared more often than articles with negative words.

positivewordrateGraph <- ggplot(statsData, aes(x = rate_positive_words, y = shares))

positivewordrateGraph + geom_point(aes(color = Day)) +

ggtitle("Number of Shares vs. Rate of Positive Words") +

ylab("Number of Shares") +

xlab("Rate of Positive Words")

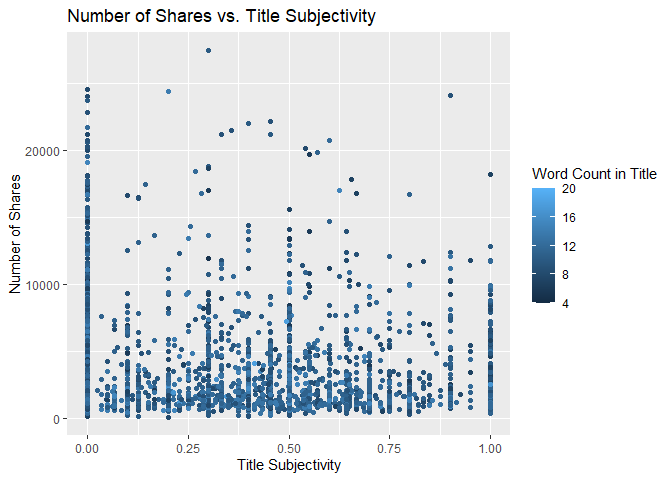

Scatter Plot of Title Subjectivity

The following plot shows the total number of shares as related to the parameter title subjectivity. A positive trend would indicate that articles are shared more often when the title is subjective. A negative trend would indicate that articles are shared more often when the title is less subjective.

titleSubjectivityGraph <- ggplot(statsData, aes(x = title_subjectivity, y = shares))

titleSubjectivityGraph + geom_point(aes(color = n_tokens_title)) +

ggtitle("Number of Shares vs. Title Subjectivity") +

ylab("Number of Shares") +

xlab("Title Subjectivity") +

labs(color = "Word Count in Title")

Modeling

In this section, we will perform regression for prediction purposes for

the data channel tech. All models were fitted using 5-fold

Cross-Validation via train() function from caret package. All

variables were scaled and centered as well.

Data Manipulation for Modeling

Subsetting Variables for Modeling

The variables selected below are those described in the introduction of

this study and will be used in the modeling section. The function

select() was used to subset the corresponding variables from the

training and test sets and two new objects are created specially for the

modeling section, dfTrain and dfTest.

dfTrain = activeTrain %>%

select(shares, starts_with("LDA_"), average_token_length,

is_weekend, n_tokens_content, n_non_stop_unique_tokens, num_hrefs,

num_self_hrefs, num_videos, average_token_length, kw_avg_min,

kw_avg_max, kw_avg_avg, is_weekend)

dfTest = activeTest %>%

select(shares, starts_with("LDA_"), average_token_length,

is_weekend, n_tokens_content, n_non_stop_unique_tokens, num_hrefs,

num_self_hrefs, num_videos, average_token_length, kw_avg_min,

kw_avg_max, kw_avg_avg, is_weekend)

Linear Regression Modeling

Linear regression is a modeling technique by which one attempts to model

a response variable (in this case shares) with one or more explanatory

variables using a straight line. A model with only one explanatory

variable is called simple linear regression (SLR). In simple linear

regression, the response variable is predicted by an intercept and a

regression coefficient multiplied by the value of your explanatory

variable. The goal of regression is to determine the intercept and the

regression coefficients. This is done by fitting a straight line across

all of the data with the goal of minimizing the residuals sum of squares

via Least Squares method. The model is fit by minimizing the sum of

squared errors (SSE).

The same concept can be applied to multiple linear regression (MLR), which has more than one explanatory variable. In this case, the goal is to determine the intercept and a regression coefficient corresponding to each explanatory variable in an attempt to minimize the sum of squared errors.

In R, MLR is generally done with the function lm. There are also a

variety of other methods that fall under the umbrella of MLR. One of

these methods, LASSO regression, will be explored as part of this

analysis.

Linear Regression Model #1: Multiple Linear Regression Using lm

Here, modeling for linear regression is done with the caret package

using the method lm. The summary function gives us the regression

coefficients.

lmFit = train(shares~., data = dfTrain,

method="lm",

preProcess = c("center","scale"),

trControl = trainControl(method="CV",number=5))

summary(lmFit)

##

## Call:

## lm(formula = .outcome ~ ., data = dat)

##

## Residuals:

## Min 1Q Median 3Q Max

## -10313.0 -1455.9 -866.1 277.0 22650.9

##

## Coefficients: (1 not defined because of singularities)

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 2683.640 39.922 67.223 < 2e-16 ***

## LDA_00 11.398 40.473 0.282 0.778251

## LDA_01 -52.337 40.920 -1.279 0.200952

## LDA_02 83.893 41.711 2.011 0.044347 *

## LDA_03 -5.727 40.939 -0.140 0.888753

## LDA_04 NA NA NA NA

## average_token_length -45.444 44.222 -1.028 0.304172

## is_weekend 235.792 40.395 5.837 5.64e-09 ***

## n_tokens_content 213.841 57.155 3.741 0.000185 ***

## n_non_stop_unique_tokens -12.935 55.469 -0.233 0.815618

## num_hrefs 157.485 55.892 2.818 0.004856 **

## num_self_hrefs -218.470 50.820 -4.299 1.75e-05 ***

## num_videos 117.295 40.544 2.893 0.003832 **

## kw_avg_min -147.259 45.996 -3.202 0.001375 **

## kw_avg_max -208.635 47.709 -4.373 1.25e-05 ***

## kw_avg_avg 467.697 48.382 9.667 < 2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 2852 on 5090 degrees of freedom

## Multiple R-squared: 0.04353, Adjusted R-squared: 0.0409

## F-statistic: 16.55 on 14 and 5090 DF, p-value: < 2.2e-16

The following table shows the output training metrics for this linear regression.

lm_out = data.frame(lmFit$results)

kable(lm_out, caption = "Output Training Metrics for Linear Regression",

digits = 3)

| intercept | RMSE | Rsquared | MAE | RMSESD | RsquaredSD | MAESD |

|---|---|---|---|---|---|---|

| TRUE | 2855.232 | 0.037 | 1757.933 | 231.097 | 0.012 | 78.415 |

Output Training Metrics for Linear Regression

The following shows the RMSE, RSquared, and MAE values for the model as it performed on predicting the test set.

metric_lm = postResample(pred = predict(lmFit, newdata = dfTest),

obs = dfTest$shares)

metric_lm

## RMSE Rsquared MAE

## 5.015551e+03 3.619879e-02 2.088571e+03

Linear Regression Model #2: LASSO Regression using glmnet

The linear regression chosen for this next model is based on penalized

regression via LASSO regression. This method has a particular advantage

of having a triangular shape of parameters search space so that it

allows the estimated coefficients to be zero. This is due to LASSO

optimization that has in the loss function the penalty associating the

sum of the absolute value of the parameters multiplied by lambda, the

penalty term (hyperparameter). Hence, LASSO regression is also a

variable selection method. In this application, we will test the

prediction capability of LASSO regression only. It was tested a sequence

of values for the Regularization Parameter (lambda), a tuning

parameter, from 0 to 10 by 1 via seq(0,10,1) assigned to the

tuneGrid =argument in the train() function from caret package. The

code below presents the estimated coefficients for the best

hyperparameter.

LASSO = train(shares~., data = dfTrain,

method="glmnet",

preProcess = c("center","scale"),

tuneGrid = expand.grid(alpha = 1, lambda = seq(0,10,1)),

trControl = trainControl(method="CV",number=5))

coef(LASSO$finalModel, LASSO$bestTune$lambda)

## 16 x 1 sparse Matrix of class "dgCMatrix"

## s1

## (Intercept) 2683.63996082

## LDA_00 0.08651943

## LDA_01 -44.86412235

## LDA_02 72.40442398

## LDA_03 .

## LDA_04 .

## average_token_length -32.20031813

## is_weekend 228.85717837

## n_tokens_content 208.46249237

## n_non_stop_unique_tokens -7.78713527

## num_hrefs 141.93239311

## num_self_hrefs -194.97804184

## num_videos 106.83337253

## kw_avg_min -121.92522564

## kw_avg_max -181.86777383

## kw_avg_avg 443.37677517

The best lambda for this model is 10 and this value can be seen in the

table below which summarizes all the metrics for the 5-fold

cross-validation.

lasso_out = data.frame(LASSO$results)

kable(lasso_out, caption = "Output Training Metrics for LASSO",

digits = 3)

| alpha | lambda | RMSE | Rsquared | MAE | RMSESD | RsquaredSD | MAESD |

|---|---|---|---|---|---|---|---|

| 1 | 0 | 2863.232 | 0.037 | 1759.106 | 208.928 | 0.018 | 62.389 |

| 1 | 1 | 2863.227 | 0.037 | 1759.094 | 208.928 | 0.018 | 62.378 |

| 1 | 2 | 2863.101 | 0.037 | 1759.013 | 208.829 | 0.018 | 62.254 |

| 1 | 3 | 2862.983 | 0.037 | 1758.947 | 208.727 | 0.018 | 62.137 |

| 1 | 4 | 2862.876 | 0.037 | 1758.884 | 208.629 | 0.018 | 62.018 |

| 1 | 5 | 2862.780 | 0.037 | 1758.836 | 208.521 | 0.018 | 61.882 |

| 1 | 6 | 2862.692 | 0.037 | 1758.788 | 208.410 | 0.018 | 61.742 |

| 1 | 7 | 2862.609 | 0.037 | 1758.744 | 208.302 | 0.018 | 61.598 |

| 1 | 8 | 2862.534 | 0.037 | 1758.711 | 208.195 | 0.018 | 61.461 |

| 1 | 9 | 2862.466 | 0.037 | 1758.684 | 208.090 | 0.018 | 61.325 |

| 1 | 10 | 2862.406 | 0.037 | 1758.663 | 207.987 | 0.018 | 61.183 |

Output Training Metrics for LASSO

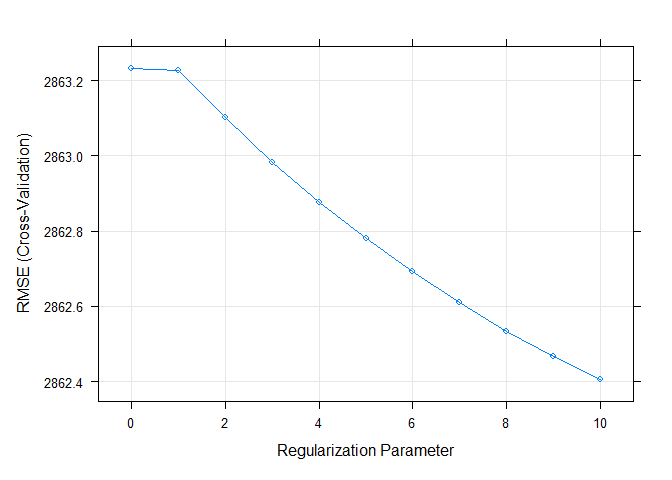

The plot below shows the RMSE by Regularization Parameter (lambda). It

is easy to see that RMSE is minimized when lambda = 10.

plot(LASSO)

The validation step for LASSO regression is applied on the test set

after predicting the response variable for unseen data (test set). By

using predict() and postResample() functions, the metrics RMSE (Root

Means Squared Error), Rsquared (Coefficient of Determination), and MAE

(Mean Absolute Error) are calculated and displayed below.

metric_LASSO = postResample(pred = predict(LASSO, newdata = dfTest),

obs = dfTest$shares)

metric_LASSO

## RMSE Rsquared MAE

## 5.018754e+03 3.568045e-02 2.089045e+03

Tree-Based Modeling

The next two models, Random Forest and Boosted Tree, are both types of tree-based modeling methods. Generally speaking, in a tree-based modeling method, the predictor space is split into regions, with different predictions for each region. In the case of regression trees where the goal is to predict a continuous response, the mean of observations for a given region is typically used to make the predictions.

To make the predictions, the trees are split using recursive binary splitting. For every possible value of each predictor, find the residual sum of squares (RSS) and try to minimize that. The process is repeated with each split. Often, trees are grown very large and need to be cut back using cost complexity pruning. This ensures that the model is not overfit and will work well on prediction of new data.

Random Forest Model

In this section, we attempt to model the data using a Random Forest model, which is a type of ensemble learning which averages multiple tree models in order to lower the variance of the final model and thus improve our prediction.

In a random forest model, we first begin by creating multiple trees from

bootstrap samples. A random subset of predictors is used to create each

bootstrap sample. The predictors are selected randomly to prevent the

trees from being correlated. If the random subset was not used (as in

another tree based method called bagging), the trees would likely all

choose the same predictors for the first split. Choosing the splits

randomly avoids this correlation. The number of predictors is specified

by mtry. The maximum number of predictors for a regression model is

generally chosen to be the total number of predictors divided by 3. Once

the bootstrap sample statistics are collected, they are averaged and

used to select a final model.

Random forest models use “out of bag” error to test the data using samples from the original data set that were not included in a particular bootstrap data set.

For the random forest model, we will use the train function from the

caret package. We set the mtry to select 1-5 predictors.

train.control = trainControl(method = "cv", number = 5)

rfFit <- train(shares~.,

data = dfTrain,

method = "rf",

trControl = train.control,

preProcess = c("center","scale"),

tuneGrid = data.frame(mtry = 1:5))

rfFit$bestTune$mtry

## [1] 1

The best mtry for this particular model was 1.

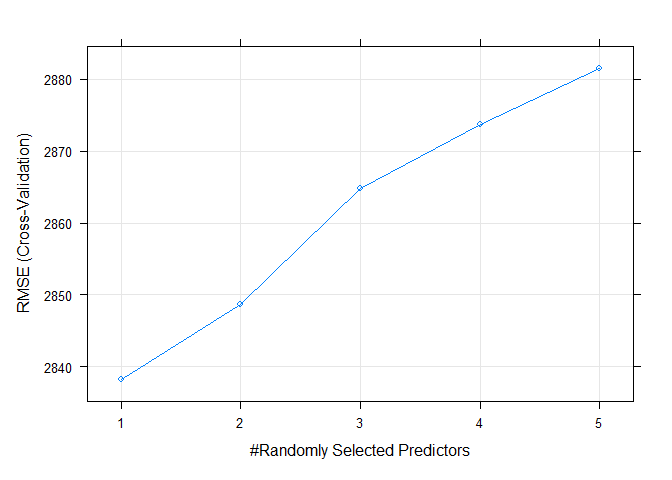

The following plot shows the RMSE values for each of the tune. The objective in random forest modeling is to choose the model with the lowest RMSE.

plot(rfFit)

The following table shows training metrics for the random forest model. Again, the best model is the one that minimizes RMSE.

rf_out = data.frame(rfFit$results)

kable(rf_out, caption = "Output Training Metrics for Random Forest",

digits = 3)

| mtry | RMSE | Rsquared | MAE | RMSESD | RsquaredSD | MAESD |

|---|---|---|---|---|---|---|

| 1 | 2838.201 | 0.051 | 1766.749 | 106.310 | 0.010 | 54.588 |

| 2 | 2848.644 | 0.048 | 1796.780 | 106.996 | 0.011 | 54.525 |

| 3 | 2864.866 | 0.043 | 1814.860 | 106.131 | 0.008 | 53.289 |

| 4 | 2873.700 | 0.042 | 1824.117 | 104.295 | 0.011 | 55.495 |

| 5 | 2881.532 | 0.040 | 1831.895 | 107.066 | 0.012 | 56.363 |

Output Training Metrics for Random Forest

Now we will run a prediction on our test data split that we obtained when we split the data based on a 70/30 split. The table shows the RMSE value for the test data set, which is an indication of how well our model worked to predict data that was not included when training the original model. We can compare this model against other models to find the model with the lowest RMSE.

RF_pred <- predict(rfFit, newdata = activeTest)

metric_rf = postResample(RF_pred, activeTest$shares)

metric_rf

## RMSE Rsquared MAE

## 4.997206e+03 4.706505e-02 2.092497e+03

Boosted Tree Model

In this section the Ensemble Learning algorithm Boosting will be

trained. Boosted tree method is one of the Tree based models most used

in data science because it presents a fitting strategy that improves

sequentially throughout the iterations. Boosting uses single trees

fitted (each single tree has d splits) on the training data and

produces predictions off of that training. The residuals of this

prediction is, then, used as response variable for the next single tree

training step. New predictions are done for this new model as well and

so on. This process occurs several times during B iterations and the

predictions are updated during the fitting process, being driven by the

shrinkage parameter, also called growth rate, lambda. These training

features of Boosting make this method to produce a reduction in the

variance of the predictions as well as gains in precision, mainly over

Random Forest, Bagging, and single tree. The shrinkage parameter will be

set as 0.1 and n.minobsinnode set as 10. The parameters n.tree and

interaction.depth will be chosen based on 5-fold cross-validation. The

former will be chosen from a sequence from 25 to 200, counting by 25.

The latter will be chosen from a sequence from 1 to 4. The code below

shows the training and tuning procedure and prints out the resultant

values of the two considered hyperparameters.

tunG = expand.grid(n.trees = seq(25,200,25),

interaction.depth = 1:4,

shrinkage = 0.1,

n.minobsinnode = 10)

gbmFit <- train(shares~.,

data = dfTrain,

method = "gbm",

preProcess = c("center","scale"),

trControl = train.control,

tuneGrid = tunG,

verbose = FALSE

)

gbmFit$bestTune$n.trees

## [1] 75

gbmFit$bestTune$interaction.depth

## [1] 2

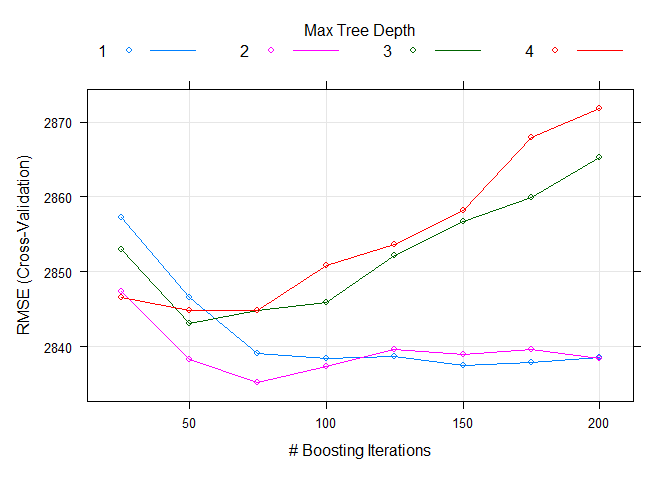

The best n.trees and interaction.depth parameters for this model are 75 and 2, respectively. These values can be seen in the table below, which summarizes all the metrics for the 5-fold cross-validation. It is easy to see that these values minimize the RMSE.

gbm_out = data.frame(gbmFit$results)

gbm_out <- gbm_out %>%

arrange(RMSE)

kable(gbm_out, caption = "Output Training Metrics for Boosting",

digits = 3, row.names = FALSE)

| shrinkage | interaction.depth | n.minobsinnode | n.trees | RMSE | Rsquared | MAE | RMSESD | RsquaredSD | MAESD |

|---|---|---|---|---|---|---|---|---|---|

| 0.1 | 2 | 10 | 75 | 2835.256 | 0.050 | 1748.003 | 212.517 | 0.011 | 63.273 |

| 0.1 | 2 | 10 | 100 | 2837.411 | 0.049 | 1744.089 | 214.689 | 0.010 | 64.799 |

| 0.1 | 1 | 10 | 150 | 2837.458 | 0.049 | 1748.162 | 207.207 | 0.014 | 56.296 |

| 0.1 | 1 | 10 | 175 | 2837.826 | 0.049 | 1743.917 | 208.351 | 0.012 | 54.858 |

| 0.1 | 2 | 10 | 50 | 2838.289 | 0.048 | 1750.229 | 207.249 | 0.009 | 60.028 |

| 0.1 | 2 | 10 | 200 | 2838.396 | 0.051 | 1740.185 | 210.381 | 0.012 | 70.185 |

| 0.1 | 1 | 10 | 100 | 2838.451 | 0.048 | 1746.244 | 207.615 | 0.012 | 56.175 |

| 0.1 | 1 | 10 | 200 | 2838.494 | 0.048 | 1743.943 | 208.451 | 0.013 | 58.987 |

| 0.1 | 1 | 10 | 125 | 2838.665 | 0.048 | 1748.324 | 207.450 | 0.014 | 58.560 |

| 0.1 | 2 | 10 | 150 | 2838.913 | 0.050 | 1741.923 | 211.143 | 0.009 | 62.996 |

| 0.1 | 1 | 10 | 75 | 2839.029 | 0.048 | 1749.316 | 208.495 | 0.012 | 59.289 |

| 0.1 | 2 | 10 | 175 | 2839.657 | 0.050 | 1744.306 | 211.794 | 0.011 | 64.090 |

| 0.1 | 2 | 10 | 125 | 2839.683 | 0.048 | 1743.534 | 214.334 | 0.009 | 69.230 |

| 0.1 | 3 | 10 | 50 | 2843.075 | 0.045 | 1748.025 | 222.347 | 0.013 | 67.385 |

| 0.1 | 3 | 10 | 75 | 2844.844 | 0.045 | 1745.765 | 221.200 | 0.011 | 71.607 |

| 0.1 | 4 | 10 | 50 | 2844.858 | 0.046 | 1753.693 | 211.087 | 0.013 | 68.563 |

| 0.1 | 4 | 10 | 75 | 2844.869 | 0.048 | 1748.371 | 214.883 | 0.013 | 68.984 |

| 0.1 | 3 | 10 | 100 | 2845.895 | 0.046 | 1747.806 | 223.915 | 0.011 | 71.380 |

| 0.1 | 4 | 10 | 25 | 2846.528 | 0.042 | 1764.193 | 208.244 | 0.009 | 66.041 |

| 0.1 | 1 | 10 | 50 | 2846.626 | 0.043 | 1758.496 | 210.036 | 0.012 | 60.242 |

| 0.1 | 2 | 10 | 25 | 2847.331 | 0.044 | 1761.935 | 210.075 | 0.009 | 62.168 |

| 0.1 | 4 | 10 | 100 | 2850.818 | 0.047 | 1752.562 | 221.171 | 0.012 | 71.224 |

| 0.1 | 3 | 10 | 125 | 2852.235 | 0.044 | 1747.469 | 225.724 | 0.012 | 71.809 |

| 0.1 | 3 | 10 | 25 | 2852.937 | 0.038 | 1760.384 | 216.781 | 0.010 | 63.694 |

| 0.1 | 4 | 10 | 125 | 2853.708 | 0.047 | 1754.022 | 219.120 | 0.011 | 71.015 |

| 0.1 | 3 | 10 | 150 | 2856.747 | 0.043 | 1752.054 | 225.617 | 0.010 | 71.103 |

| 0.1 | 1 | 10 | 25 | 2857.255 | 0.040 | 1768.748 | 210.789 | 0.011 | 60.095 |

| 0.1 | 4 | 10 | 150 | 2858.221 | 0.047 | 1759.407 | 217.599 | 0.010 | 69.077 |

| 0.1 | 3 | 10 | 175 | 2859.928 | 0.043 | 1755.121 | 225.644 | 0.010 | 72.722 |

| 0.1 | 3 | 10 | 200 | 2865.295 | 0.042 | 1760.725 | 222.608 | 0.010 | 67.496 |

| 0.1 | 4 | 10 | 175 | 2867.915 | 0.044 | 1766.602 | 222.489 | 0.011 | 76.572 |

| 0.1 | 4 | 10 | 200 | 2871.784 | 0.044 | 1772.723 | 217.188 | 0.009 | 71.988 |

Output Training Metrics for Boosting

The plot below shows the RMSE by Number of Boosting Iterations and display Max Tree Depth lines for the 5-fold CV performed. It is easy to see that RMSE is minimized when n.trees = 75 and interaction.depth = 2.

plot(gbmFit)

The validation step for Boosting is applied on the test set after

predicting the response variable for unseen data (test set). By using

predict() and postResample() functions, the metrics RMSE (Root Means

Squared Error), Rsquared (Coefficient of Determination), and MAE (Mean

Absolute Error) are calculated and displayed below.

gbm_pred <- predict(gbmFit, newdata = activeTest)

metric_boosting = postResample(gbm_pred, activeTest$shares)

metric_boosting

## RMSE Rsquared MAE

## 4.987962e+03 4.891964e-02 2.072540e+03

Model Comparison & Conclusion

For the overall comparison among all 4 created models in previous sections, the test set was used for predictions and some quality of fit metrics were calculated based on these prediction on unseen data. The code below shows the function that returns the name of the best model based on RMSE values estimated on the test set. The code below displays the table comparing all 4 models.

bestMethod = function(x){

bestm = which.min(lapply(1:length(x), function(i) x[[i]][1]))

out = switch(bestm,

"Random Forest",

"Boosting",

"LASSO Regression",

"Multiple Linear Regression")

return(out)

}

tb = data.frame(RF = metric_rf, Boosting = metric_boosting,

LASSO = metric_LASSO, Linear = metric_lm)

kable(tb, caption = "Accuracy Metric by Ensemble Method on Test Set",

digits = 3)

| RF | Boosting | LASSO | Linear | |

|---|---|---|---|---|

| RMSE | 4997.206 | 4987.962 | 5018.754 | 5015.551 |

| Rsquared | 0.047 | 0.049 | 0.036 | 0.036 |

| MAE | 2092.497 | 2072.540 | 2089.045 | 2088.571 |

Accuracy Metric by Ensemble Method on Test Set

After comparing all the 4 models fit throughout this analysis, the best model was chosen based on the RMSE value, such that the model with minimum RMSE is the “winner”. Therefore, the best model is Boosting based on RMSE metric. The RMSE, coefficient of determination, and MAE metrics for all 4 models can be seen in the table above.

Reference List

K. Fernandes, P. Vinagre and P. Cortez. A Proactive Intelligent Decision Support System for Predicting the Popularity of Online News. Proceedings of the 17th EPIA 2015 - Portuguese Conference on Artificial Intelligence, September, Coimbra, Portugal.